United States sales tax is one of the most complex sales tax systems in the world. Navigating the waters of U.S. sales tax can be a shock for international sellers expanding into the States. The complexity of it all can be tough even for sellers living in the U.S.!

This article will detail the 5 most important things online sellers need to know about U.S. sales tax.

The Basics of U.S. Sales Tax

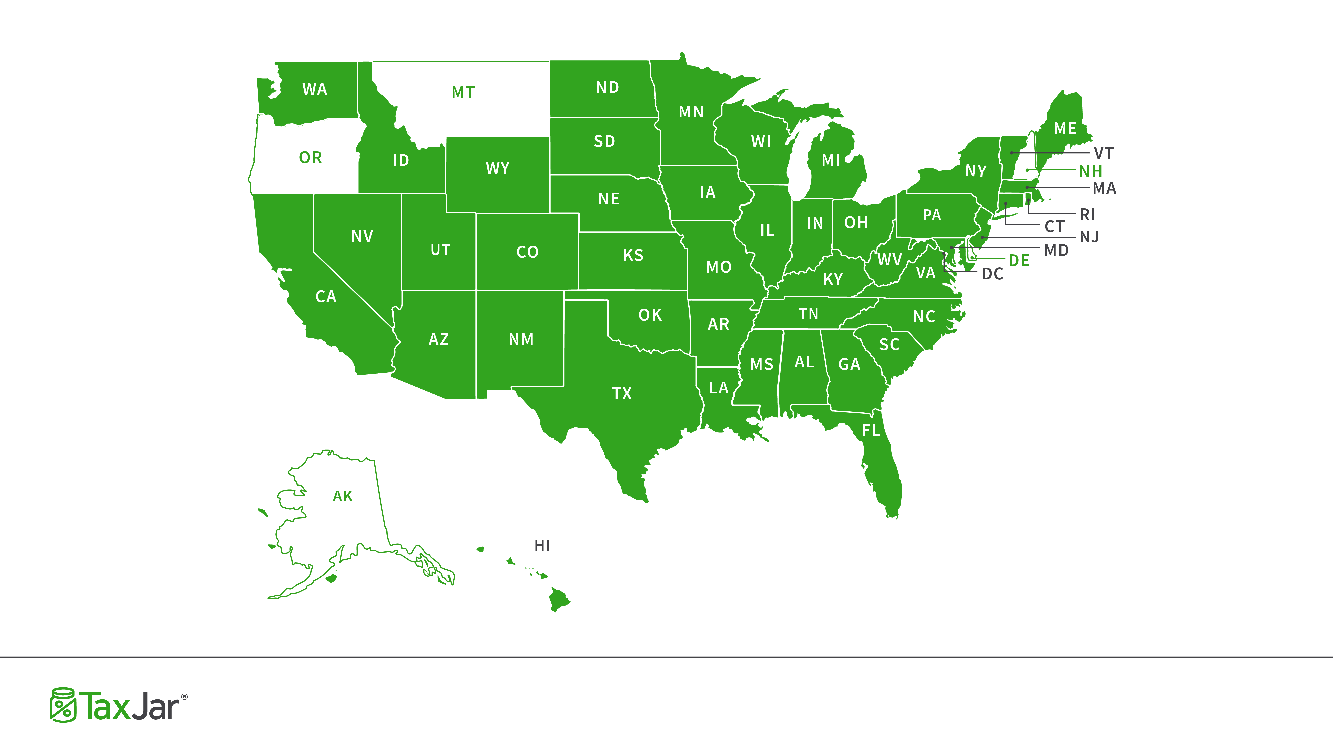

The U.S. has no nationwide sales tax. Instead, it is governed at the individual state level. Forty-five out of fifty states (and Washington D.C.) all have a sales tax. These states get to make their own rules and laws when it comes to administering the tax. One of the main reasons that U.S. sales taxes very quickly gets confusing. There just aren’t many rules of thumb

Most U.S. states also allow local areas to levy a sales tax. That’s how a sales tax rate may end up being an odd number like 8.813%. (Which is, by the way, that’s the real sales tax rate in Stillwater, Oklahoma. It’s made up of the 4.5% Oklahoma state sales tax rate, the .813% Payne County sales tax rate, and the 3.5% Stillwater city sales tax rate.)

In the U.S., merchants are required to collect sales tax from their buyers and then pass that sales tax on to the state’s taxing authority. States and local areas use sales tax to pay for budget items like schools, roads and fire departments. So, they are very interested in ensuring they collect their fair share.

Nexus: Where a Seller is Obligated to Collect Sales Tax

Collecting and filing sales tax in all forty-five states and Washington D.C. would be both time-consuming and confusing. Fortunately, most businesses are not required to collect sales tax from buyers in every state.

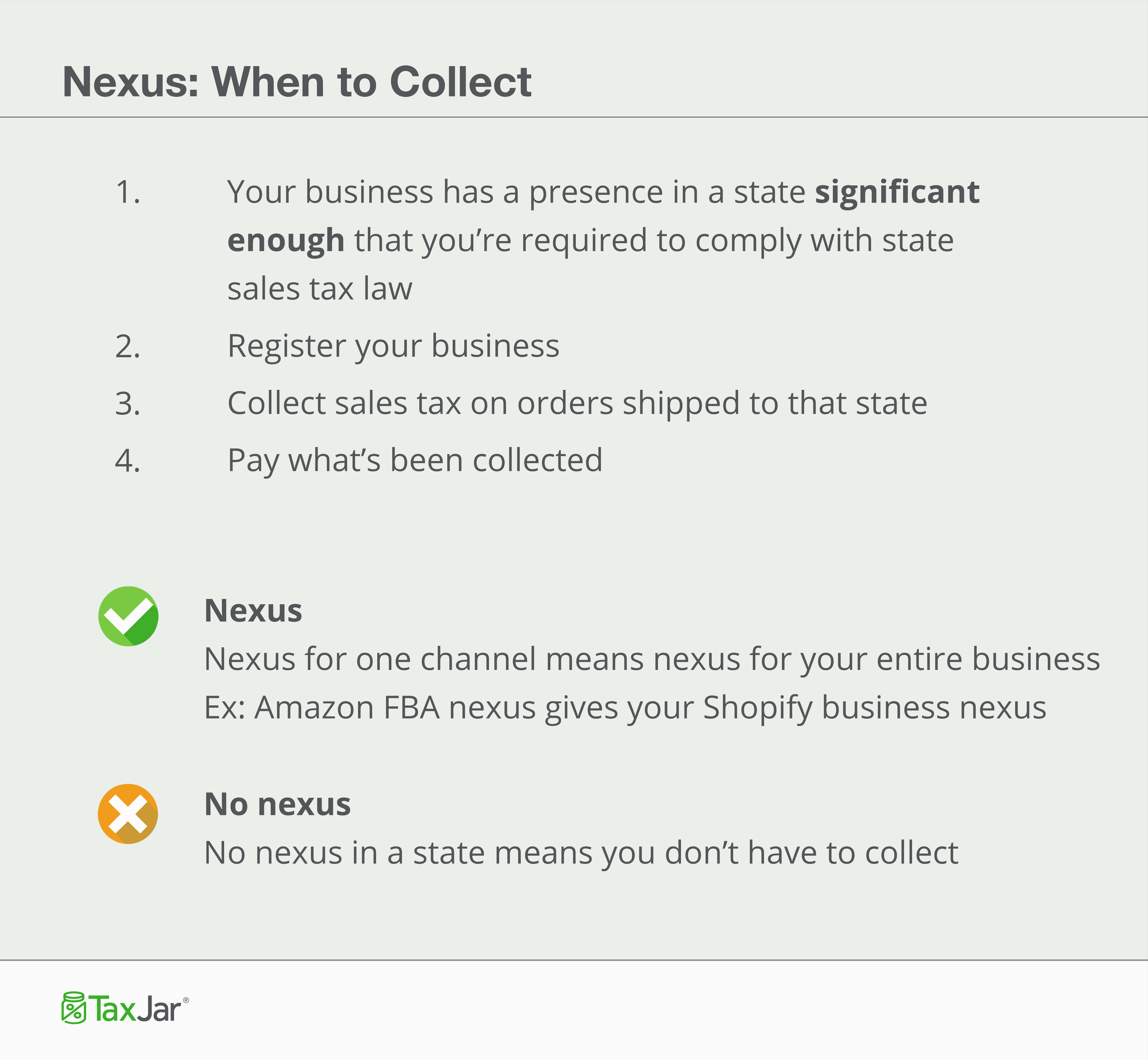

Instead, merchants are only required to collect sales tax when they ship an item to a buyer in a state where they have sales tax nexus.

Sales tax nexus is just a legal term for “connection” to a state. If a seller has nexus in a state, they are required to collect sales tax from buyers in that state. If a seller does not have nexus in a state, they are not required to collect sales tax from buyers in that state.

While every state’s nexus laws are different, there are common factors that create sales tax nexus:

- It’s your home state – If you live and run your business in a U.S. state, you’ll always have home state nexus

- A location – a store, office, warehouse, factory or other location creates nexus

- An employee – employees, many contractors, salespeople, installers and others create nexus

- Inventory for sale – If you have inventory for sale in a state then you

- A drop shipping relationship – depending on your negotiations with your drop shipper, you may have nexus if you drop ship

- An affiliate – some states consider 3rd party affiliates who send customers to your store to create nexus

- Temporary business activity – In some states, if you sell within their borders for just a handful of days (such as at a tradeshow or craft fair) then you have nexus there

If you have nexus in a state, your first order of business is to register for a sales tax permit in that state, and then begin collecting sales tax from buyers in that state.

Sales Tax Collection: Every Platform is Different

Once you are registered to collect sales tax, your next step is to set up sales tax collection on the shopping carts and marketplaces where you sell your products.

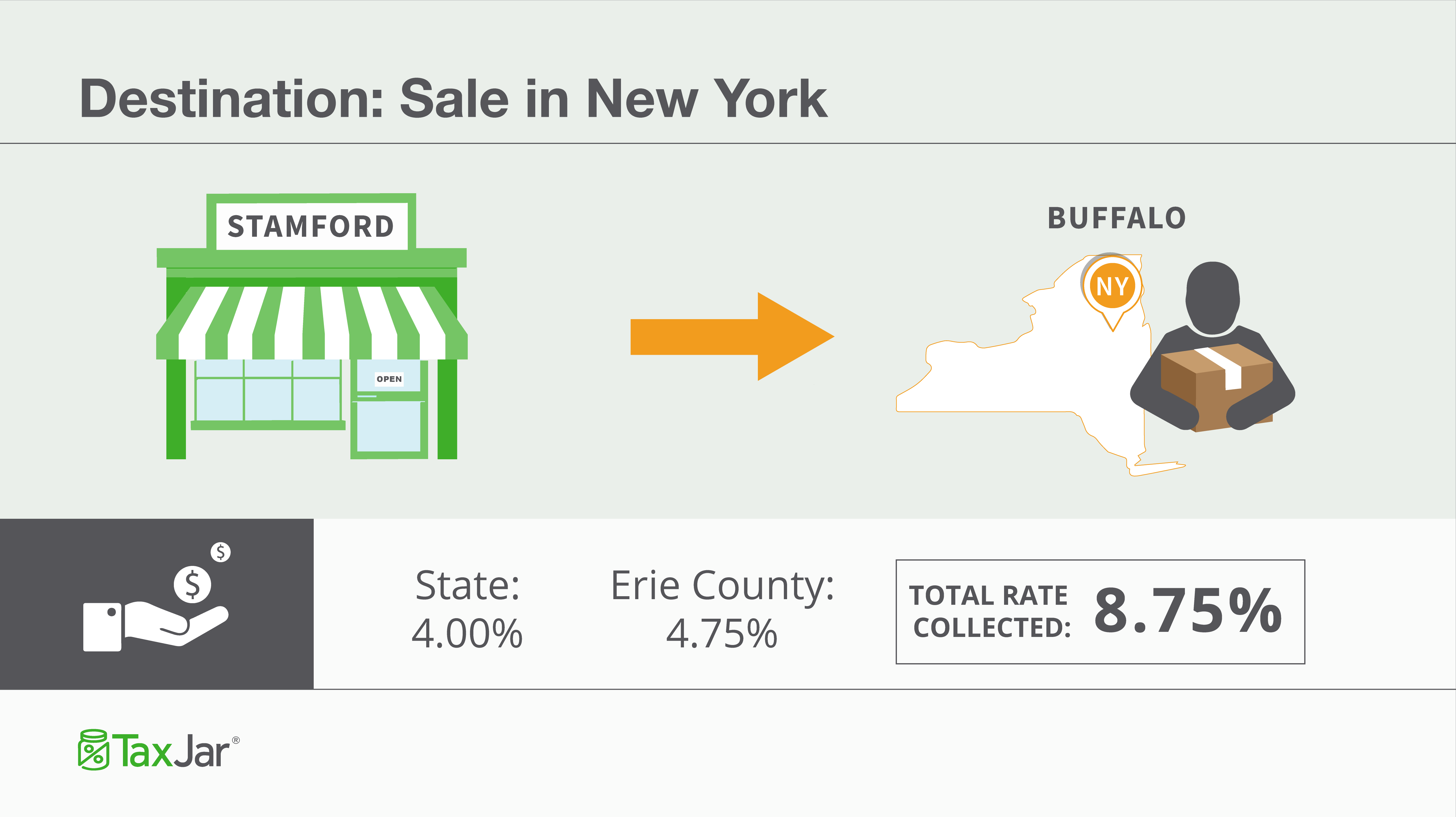

In eCommerce, you almost always collect sales tax at the sales tax rate at the buyer’s ship to address. Here’s an example:

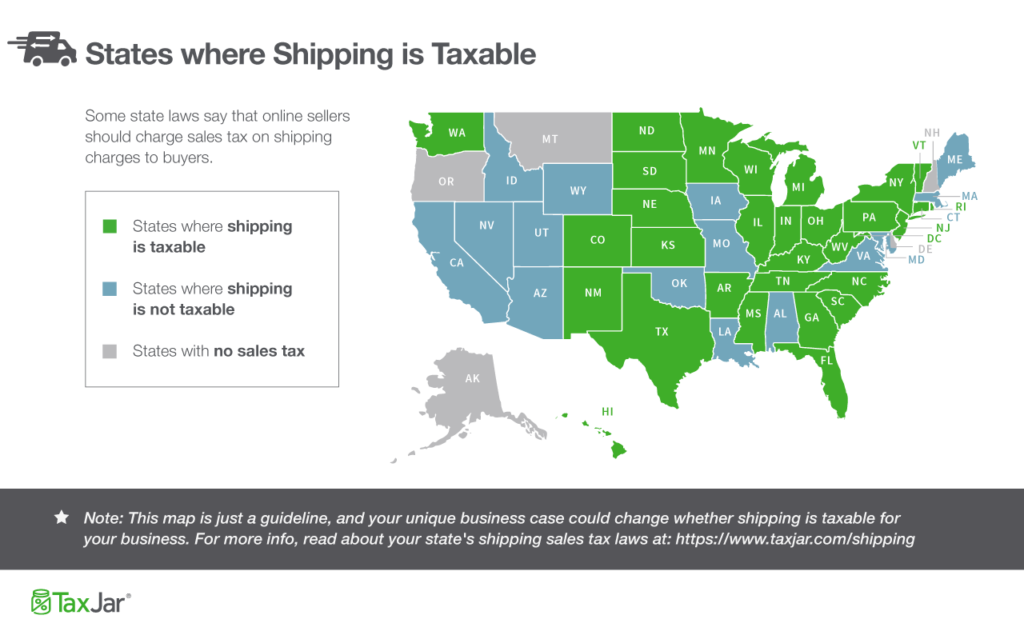

About half the states with a sales tax require sellers to charge sales tax on shipping charges, too. Here’s a map of states that require sales tax on shipping:

Most online shopping carts and marketplaces allow you to choose whether to collect sales tax on shipping.

There are two other important things to remember when collecting sales tax:

- Collect sales tax on ALL shopping carts in ALL nexus states – For example, you have nexus and must collect sales tax in five states. Be sure you set up all your online sales channels to collect sales tax from buyers in those five states.

- Each shopping cart and marketplace is different – Most modern online shopping carts are robust and allow you to collect the right amount of sales tax from buyers. But some, like eBay, have not modernized and only allow online sellers to collect a single sales tax rate. It can be confusing to set these shopping carts up, so we have guides to setting up sales tax collection on the most common online shopping carts and marketplaces here.

Reporting Sales Tax: It’s All about the Data

Soon enough, your sales tax filing due date will roll around. Which means it’s time to gather your sales tax data and format it in the way your state wants to see it.

A Quick Note about U.S. Sales Tax Due Dates

When you register for your U.S. sales tax license, the state will assign you a sales tax filing due date and filing frequency. Though the filing frequency may vary, it is generally either monthly, quarterly or annually. In most cases, the more sales tax you collect from buyers in a state, the more often that state wants you to file and pay sales tax.

Gathering Sales Tax Data

This is the most time-consuming aspects of dealing with sales tax in your business. States want you to gather how much sales tax you collected from every buyer in the state, on all your sales channels. But then they require you to go the extra step. Break down how much sales tax you collected in each city, county, or other special taxing jurisdiction. You’ll need to know if your buyer lived within city limits, or their address fell within a special transit or educational district.

That’s where sales tax automation saves the day. With sales tax automation, you can connect with all the shopping carts and marketplaces on which you sell and slice and dice your data into a report that shows your sales tax collected just the way the state wants to see it on your sales tax return. This saves hours of trying to figure out which percentage of tax you collected from which buyer. Whew!

Filing Sales Tax: Don’t Run into these Snags

Once you’ve reported how much sales tax you’ve collected, then it’s time to file your sales tax return and remit the sales tax funds to the state.

Most states allow you to file sales tax online, and some even require it. There are a couple important things to remember when filing sales tax returns:

- Always file a sales tax return, even if you didn’t collect any sales tax – Sometimes you may put your business on hiatus or just have a slow season. But you are always required to file a sales tax return by the due date. Even if you don’t have any sales tax to report or remit. States will charge you a fine (usually about $50) for missing a sales tax filing, so don’t forget to file!

- Take advantage of sales tax discounts – About half the U.S. states with a sales tax will let you keep a tiny (usually 1-2%) amount of the sales tax you collected. While this amount is small, it’s free money!

Breaking down your sales tax data and filing sales tax returns is a hassle, so keep in mind that if you’re spending too much time on sales tax, you can also AutoFile your sales tax returns and take them completely off your plate.

Non-U.S. Sellers and U.S. Sales Tax

Even sellers who do not live in the U.S. may find themselves with sales tax nexus in the U.S. If you have a location, employee, affiliate or inventory stored in a warehouse (such as through Amazon FBA) in a U.S. state, then you will likely have sales tax nexus in that state. State taxing authorities don’t care if you live 2 states away or halfway around the world. They just want merchants to collect sales tax!

If this sounds like you, we’ve written a Sales Tax Guide for International Sellers Selling into the U.S. to help you navigate the waters of U.S. sales tax compliance!

I hope this post has answered your questions about U.S. sales tax. If you have more, feel free to join us in our Sales Tax for eCommerce Sellers Facebook group.

Boost your revenue with retail-ready product photos. Try Pixc today for FREE.

TaxJar is a service that makes sales tax reporting and filing simple for more than 10,000 online sellers. Try a 30-day-free trial of TaxJar today and eliminate sales tax compliance headaches from your life!