When you’re running an eCommerce store, the right payment processing system can either make or break your business.

Hidden fees, clear access to funds and the right support when you need it are crucial pieces to the puzzle when you want to keep focusing on what you love: delighting buyers and growing your profits.

One payment processor is PayPal, which has been around since the dinosaurs; most know of it and many of us use it on our own sites by default.

An alternative is Stripe, a fairly new payment processor that many people think is much more straightforward than PayPal. (I’ll admit I do like Stripe a lot!)

Let’s start the Paypal vs Stripe face-off. Feel free to do a happy dance as I’ve done the research for you about what benefits both processors have to offer!

Paypal vs Stripe Round 1: Paypal

Takes customers away from your site

Most of us know that when we shop with PayPal, we’re directed to the PayPal site payment form where we either log in to our PayPal account or use a credit/debit card.

Fees

- 2.1% to 3.4% AUD + a flat fee

- Withdrawal fee $0, Return fee $5.

That’s all PayPal will reveal about the Business Accounts fee structure.

PayPal Payments Pro

A merchant account and gateway in one, this method will allow you to accept credit/debit cards and PayPal directly on your website.

PayPal hosts the payment pages behind the scenes, so you control the customer experience while letting them handle data security. Payments Pro works with the most popular shopping carts, such as Magento, Cart32, Shopify, WooCommerce and hundreds of other eCommerce solutions, software and/or plugins.

Fees for Pro

- $30 USD monthly

- No set-up fees

- No cancellation fees

- Transaction fees: 2.5% to 3.4% + $0.30 per transaction (AUD)

Ease of use

I must admit the new PayPal tools are looking pretty spiffy! This may make running things on the back-end a little easier.

Lack of transparency

Though my years with PayPal and hours of research just to get a clearer picture of their fees, I really had to dig deep and I’m still confused about standard business fees. That’s just one example.

Support

Say what now? I gave up at 15 days after enquiry. Perhaps someone else has had better luck.

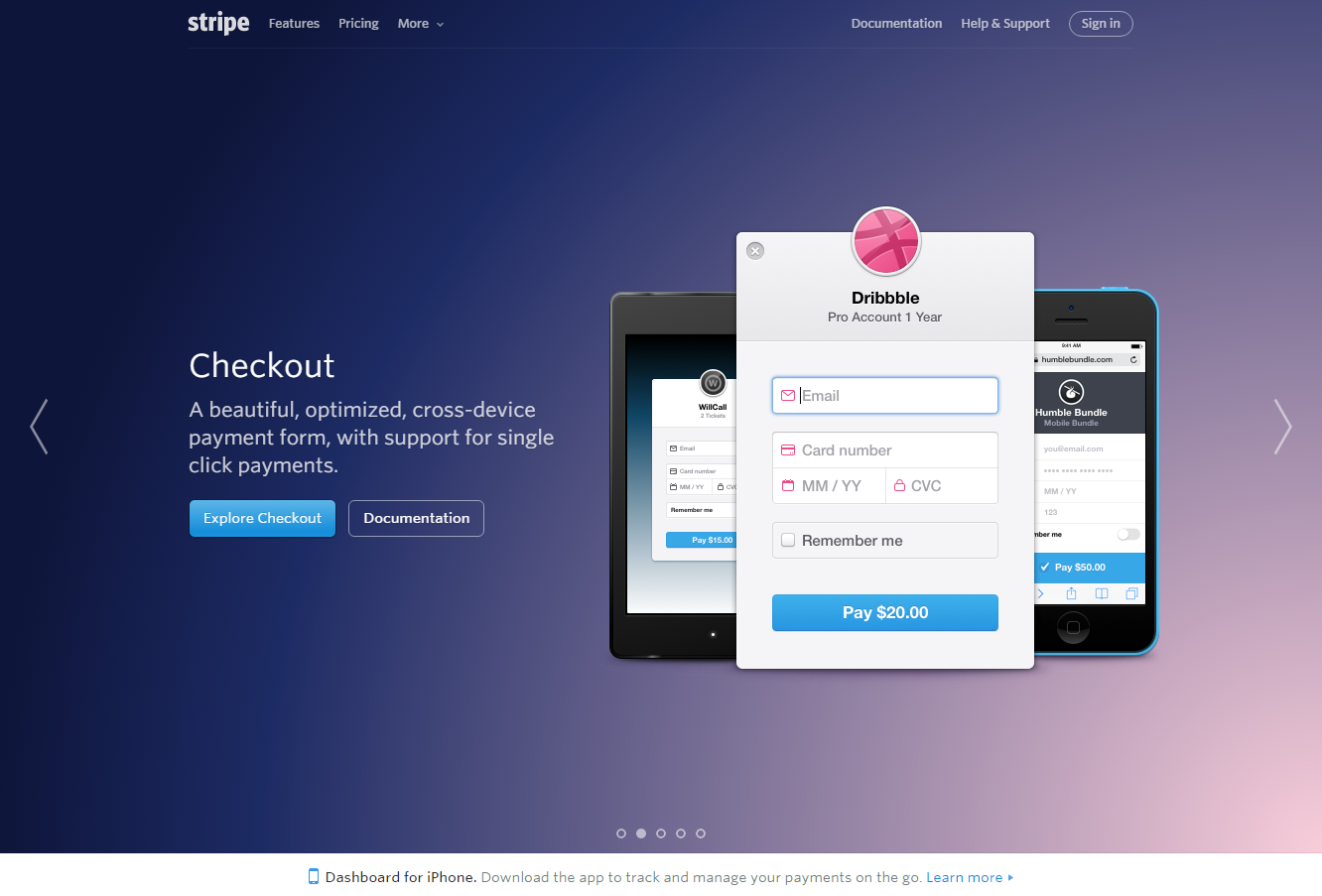

Paypal vs Stripe round 2: Stripe

Let’s take a look at why I think Stripe is a breath of fresh air and what it has to offer.

Stripe was founded in 2010 by young Irish lads (nerds) named Patrick and John Collison. What’s not to love about an Irish guy called Patty! When you hear him speak passionately about why and how he created Stripe you’ll realise his company is a modern, interesting, relevant and relatable solution for the new generation of eCommerce site owners.

I really love Patrick’s philosophy on his startup success and about wanting to make 100 people really happy, rather than making a lot of people a little bit happy.

Stripe allows you to keep visitors on your site during the whole shopping experience by processing credit and debit card payments directly on your website, worldwide, without the need for a merchant account. As a conversion-centric web developer, I can tell you the better your website keeps visitors sticking around, the better it will convert.

Your website should be all about the user experience, especially when you’re running an online store, and Stripe makes the whole transaction process easy, secure and responsive (with a beautifully optimised payment form for cross-device usability: computer, tablet and mobile).

Payments from start to finish

A flexible set of tools and functionality for modern commerce.

Security

No-hassle security and compliance. By using any of Stripe’s products/features (Stripe.js, API, etc.), you’ll automatically be compliant with the strictest PCI requirements.

Stripe came up with a smart way of having it both ways. It allows people to enter credit card info directly on your site without you storing the credit card details, so you don’t have to deal with any of the payment processing risks and no sensitive data actually hits your server.

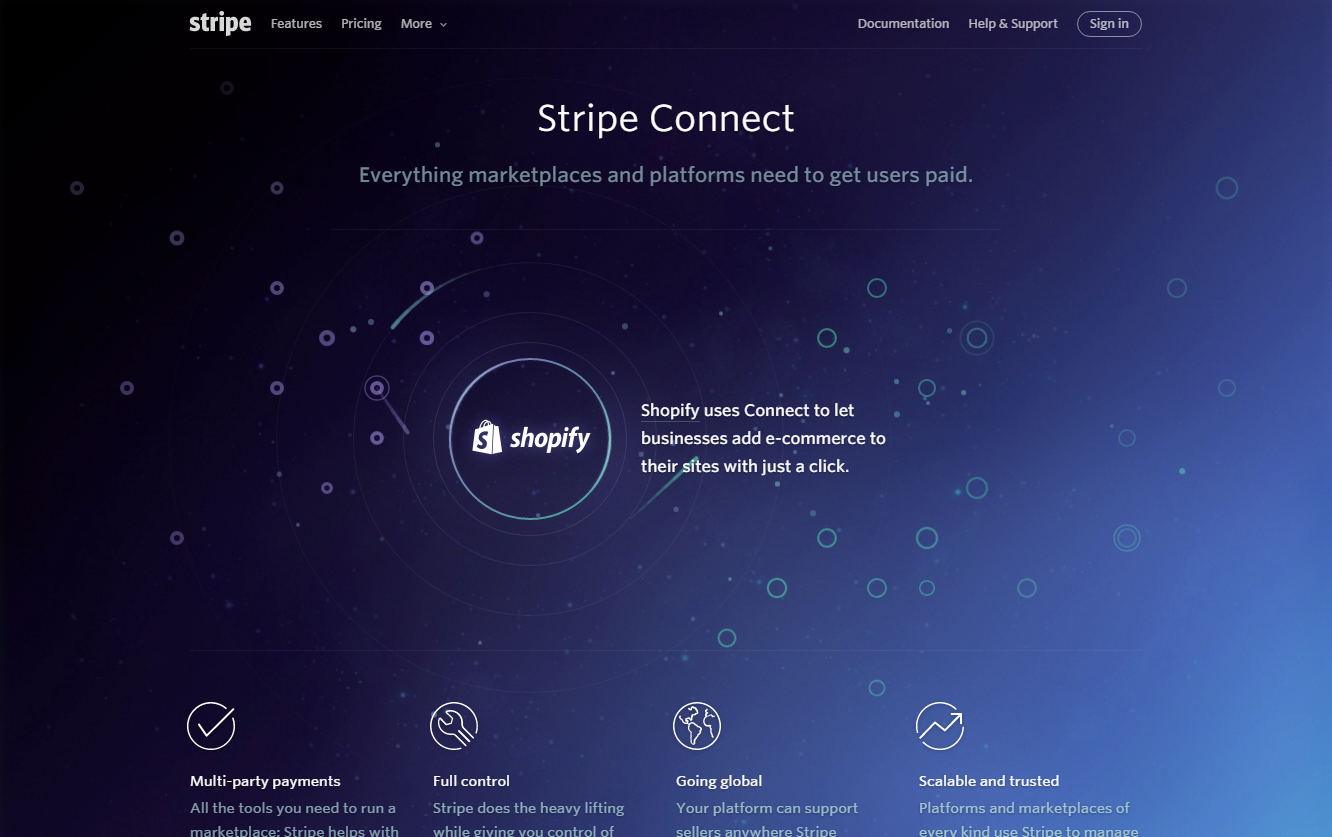

Stripe Connect

This is where your customers can sign up for a Stripe account within your own onboarding flow and then process payments within your marketplace. Stripe deals with all of the payment flows and sends money directly to you. You can even charge a fee on the transactions they pay to you. The other benefit is transactions are between the seller and the buyer, meaning you are not liable for any disputes.

Offer special deals and coupons to your users

With Stripe, you’re able to create special percent-off discounts to select customers. Coupons do only apply to invoices created for recurring subscriptions and invoice items; they do not apply to one-off charges.

Australian fees:

- 2.7% + 30¢ per successful charge.

- No monthly fees.

- No refund costs.

- If you refund a transaction, Stripe will return the entire fee.

- Stripe has no setup fees and no card storage fees.

- Currency conversion incurs a 2% fee atop market exchange rates.

- Stripe don’t charge you extra for failed transactions, AMEX or international cards, or recurring payments.

For more information, go to https://stripe.com/au/pricing.

Stripe currently transfers funds on a seven-day rolling basis. However, once a seller has processed some volume, Stripe is happy to talk one-on-one to see if they can move you to a four-day payment rollover.

Support

From firsthand experience with both PayPal and Stripe, I can tell you I’m really impressed with Stripe getting back to me on a couple of occasions within 24 hours. And they didn’t send a generic email; they actually took the time to really help me with my research and queries.

Technical specifications

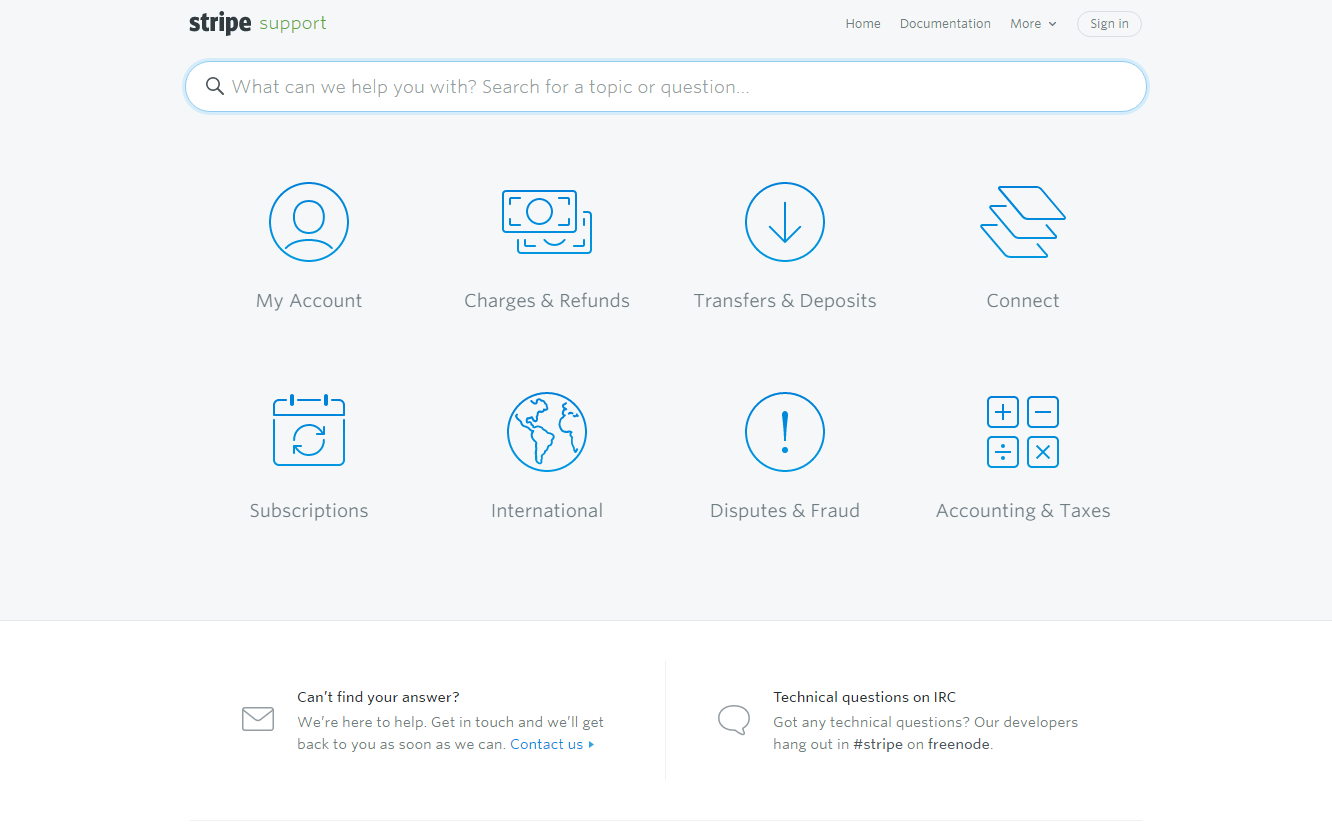

You’ll first have to register at https://stripe.com (it’s free to sign up).

Before you can start accepting live payments, you need to confirm your email address.

Tip: No matter the size of your business, it’s always good to have a separate email for all things financial, e.g., accounts@businessname.com.

If you use WordPress, Stripe will need version 3.6.1 and above to run properly. There are free Stripe plugins.

Stripe can seem a little technical at first; however, there are options for ready-made forms with customisable payment fields and no need for coding. If you do need help, of course there is plenty of support and documentation available.

Pick the processor that’s best for your business

So there you have it. PayPal vs Stripe might be a debate that might rage on for a while. Personally, I like Stripe a lot! But it’s your business, so choose the one that best fits your needs.

Of course everyone has different preferences, but knowledge is power. Use that knowledge and your customers will thank you with their mouse clicks.